- In 2008 the franc was approximately 2 PLN. Back then however, zloty was very strong in relation to the majority of currencies. A chance for such a big enforcement of our national currency, is very unlikely today. But is there a possibility, that the weakness of the Swiss currency, will relieve payers of loans denominated in the franc? - asks Marcin Lipka, currency analyst.

PDF Download (473.2 kB)

Creation of movements on currencies

According to the “textbook”, when we are talking about macroeconomic variables having impact on currency evaluation, we include the difference between the anticipated interest rate and inflation, trends on current account, the expected condition of national economy, or the foreign monetary policy.

However, there are no such significant changes between the above parameters in developed economies, to justify the movement on currencies to limits of a several dozen percent within a short period of time. Thus, there must be a different factor, which causes the rates to change more swiftly, than the previously mentioned foundations would have indicated.

The catalyst of changes in short, mid, or even long term, is the flow of capital. Many claims, that we currently observe such a situation, e.g. on Swiss franc. However, we have to define what is the capital's aim and its origin, in order to know if this disturbance will maintain longer, or be corrected relatively quickly.

Crucial flow of capital

It is quite often repeated, that the franc is strengthening thanks to the fact, that it is considered to be a safe currency. In moments of economic disturbances, especially in Europe, it is this currency, to which investors escape. On one hand they want to protect their capital, on the other they assume, that the franc will gain in value. Apart from speculation, elements that always go hand in hand with increased variability, the key is to understand, will the foreign market participants locate their assets in the franc only for a while, or are the national companies or pension funds return with their capital “home”.

Unfortunately, as the latest analysis of Deutsche Bank published in the “Financial Times”, and also Pinar Yesin (senior economist in Swiss National Bank (SNB)) elaboration shows, main responsibility for strong increases in the franc's value and flow of capital, falls on the citizens and companies from Switzerland. The “ghost” of relatively slow economic growth abroad, combined with the perspective to increase the franc's value, causes that instead of re-investing their profits in eurozone countries or emerging markets, they think it is better to wait through the rough times on their home market.

If those hypothesis will be confirmed, it may mean, that we will have to wait for a deeper overestimation of the franc until a clearer economic revival in Europe and the world. In the short term, there is only a chance, that in perspective of a few months a part of the speculated capital will make a profit, and slowly withdraw from the franc. This however will not be enough to clearly decrease the evaluation of the Swiss currency.

Revaluation

The fact that the franc will not get much cheaper within weeks or months, is negative information. However,it is worth noticing, that the Swiss currency is seriously overvalued. In time, this revaluation should be corrected, and even as the historical data indicate, we will probably see the franc's undervaluation in comparison to longtime trends.

According to Bruegel, independent “think tank”, franc's revaluation measured with REER method, amounted over 40%, with the rate close to a parity with the euro. Although, a comparison of the Swiss currency with the basket of its partners' currencies, and including inflation in calculations, is not a perfect examination method. However, if one element is added there, we should get a relatively credible result.

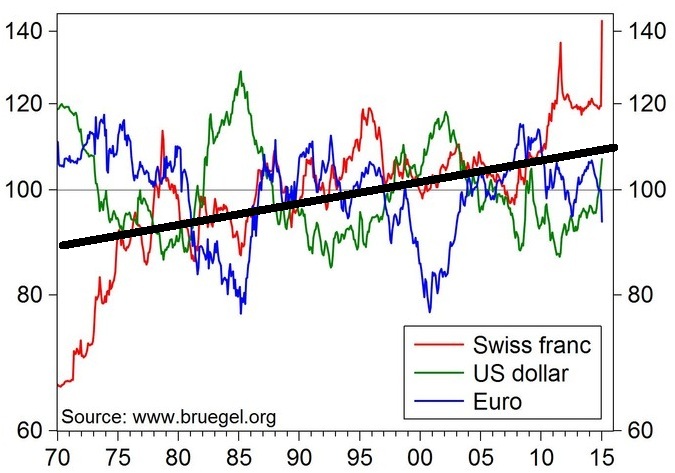

Value of the Swiss franc in relation to the currencies' basket (in attachment).

Source: Bruegel, UBS. The chart (red line) presents the evaluation of the Swiss currency by REER method in the last 45 years. The increase means the franc's enforcement in relation to the basket of Swiss commercial partners currencies, including the inflation changes between national and foreign economies. Value of 100 is the average in period 1970-2015. Bold black line (UBS data) is a line of trend, that amounted 90 in 1974, and currently amounts 110.

This fitting element is the trend line (UBS data), which corrects REER by the observed increase of the Swiss economy's competitiveness. Throughout the most recent decades, Switzerland became one of the most effective and high margin countries in the world.

The unprecedented development of the pharmaceutical market, or investments in modern technologies, combined with traditionally strong position on luxury goods and financial services markets, have caused Switzerland to record a surplus on their current account (C/A) for years. This competitive advantage is very well shown by REER trend line.

Capital flows again

When we will look at Bruegel chart again, we will notice that throughout years we had many periods, when the franc clearly lost its value. Usually this is a result of a milder monetary policy, than it was in the other countries. It was caused by e.g. the periods of downturn, often caused by too strong a national currency. In fact, it was the first reason for the franc's later wear off.

The second reason was the fact that it was more profitable for companies, as well as citizens, to locate their money in different countries, because development was better to achieve there, than in stagnant Switzerland. Thus, we had to deal with the exact opposite situation than now.

The data from Swiss balance of payments from the 90's, look quite good. In this period, the economy of Switzerland developed in mid tempo of +6.6% y/y (data from OECD 1991-1999). A much faster increase of GDP abroad and currency's revaluation in the mid 90's, caused the chances for a higher return of capital, were searched outside of Switzerland.

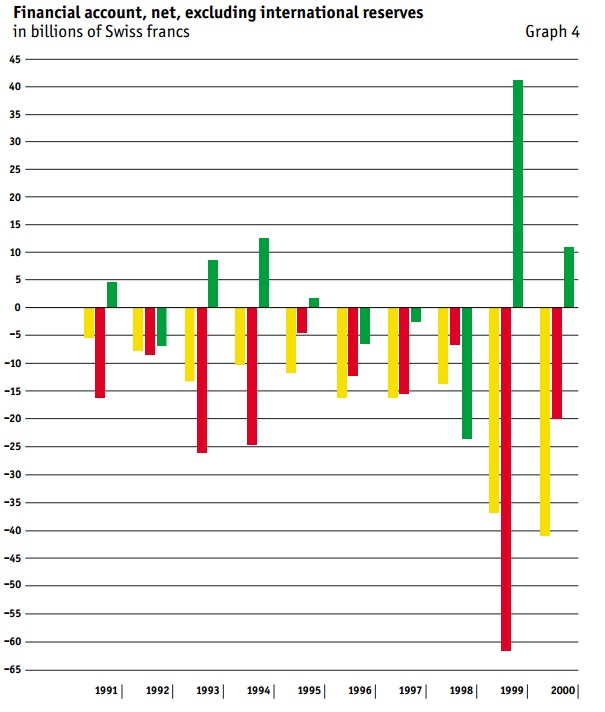

Swiss financial account in the 90's.

Source: Swiss Central Bank (SNB). Financial bill of Swiss balance of payment shows direct netto investments (yellow line), wallet netto investments (red line), and other investments (green line). Minus means the capital's outflow from Switzerland.

Quite significant outflow of national capital, combined with mild monetary policy, caused not only REER depreciation of the Franc by 20%, but e.g. a nominal decrease of the Swiss currency value in relation to the American dollar, by almost 40%.

Chart of CHF/USD in the years 1995-2000.

Source: Bloomberg. Decrease of CHF/USD rate means franc's wear off in relation to the dollar. In this period depreciation of Swiss currency in relation to the American, amounted 37.2%. Standard quotation of USD/CHF has been reversed.

The repitition of such a scenario cannot be excluded. It is probable, especially that some elements in favor of the franc's wear off, are beginning to appear . Despite resigning from maintaining the EUR/CHF rate above 1.20, SNB leads currently a very mild monetary policy, and trying to prevent the Swiss economy from entering the stagnation-deflation period.

Everything indicates, that the current actions will continue, until the trends in the capital flow will not turn, and the economy will have even better perspectives. First of all, “the speculation balloon” needs to be removed. It will probably begin to shrink significantly, when the losses related with negative interest, will begin to exceed the profits, coming from the probable further increase of franc's value.

Another element, which certainly seems to be more extended in time, is the return of the world's economy on the path of increase. Until now, the only countries with developed economies that managed to do this, are the United States, and partly the United Kingdom. A key to more fundamental changes, is a faster economic development in Europe, and in the emerging markets. When can it occur? If we were to trust the EBC prognosis, the eurozone will reach a pace above, 2% per year, as soon as 2017.

If it happens, Swiss companies and investment funds, will begin to invest abroad, just as they did in the past. The influence of capital denominated in CHF, will cause the franc's wear off. This long term trend will probably be enforced by speculative actions, which is the loaning of low-interest Swiss currency and locating the capital in assets, that bring higher profits. This will be the culmination moment of the franc's weakening.

In conclusion

The franc's wear off mentioned in the title, is certainly not a matter of weeks or months. However, considering the historical trends, unique revaluation of the Swiss currency, its strong dependance from the business cycle and probable monetary policy of the Swiss, it is not excluded that we may deal with the franc's clear wear off.

Of course at this moment it is difficult to foresee, will the CHF depreciation in a presented scenario, amount 20, 30 or 40%. However, observing this unprecedented increase of the franc's value in recent years, we can expect not only the return to REER trend, but also a visible downward deflection from its average.

Thus, the increase of the franc's value by 1/3 in relation to its foreign partners, is not only a hypothetical scenario. Additionally, the lower value of the CHF, is usually combined with appreciation of emerging currencies, which also include the zloty. A combination of both movements in a culmination moment, could enforce the zloty in relation to the franc by over 40%. It would result in the franc dropping even to around 2 PLN.

*Marcin Lipka - Analityk Cinkciarz.pl

A graduate of Management of the University of Warsaw. He has also obtained the Global MBA title at the University of North Florida (USA), Fachhochschule Koeln (Germany) and Dongbei University of Finance & Economics (China). He has been involved with capital markets for several years. Since September 2012 he has been a member of the Cinkciarz.pl team.